MANUFACTURING SECTOR GROWS BY 9.9 PER CENT IN FY24; CONSTRUCTION ACTIVITIES ALSO REGISTER A GROWTH OF 9.9 PER CENT GROSS FIXED CAPITAL FORMA...

MANUFACTURING SECTOR GROWS BY 9.9 PER CENT IN FY24; CONSTRUCTION ACTIVITIES ALSO REGISTER A GROWTH OF 9.9 PER CENT

GROSS FIXED CAPITAL FORMATION (GFCF) FROM PRIVATE NON-FINANCIAL CORPORATION’S INCREASES BY 19.8 PER CENT IN FY23, ACTS AS AN IMPORTANT DRIVER OF GROWTH

WITH 4.1 LAKH RESIDENTIAL UNITS SOLD IN THE TOP EIGHT CITIES,IN 2023 REAL ESTATE WITNESSES 33 PER CENT Y-O-Y GROWTH, HIGHEST SINCE 2013

FISCAL DEFICIT OF UNION GOVERNMENT DOWN FROM 6.4 PER CENT OF GDP IN FY23 TO 5.6 PER CENT IN FY24

CAPITAL EXPENDITURE FOR FY24 STANDS AT ₹9.5 LAKH CRORE MARKING AN INCREASE OF 28.2 PER CENT ON Y-O-Y BASIS, AND 2.8 TIMES THE LEVEL OF FY20

₹36.9 LAKH CRORE TRANSFERRED VIA DIRECT BENEFIT TRANSFER SINCE ITS INCEPTION IN 2013

FEMALE LABOUR FORCE PARTICIPATION RATE GROWS FROM 23.3 PER CENT IN 2017-18 TO 37 PER CENT IN 2022-23, MAINLY DUE TO RISING PARTICIPATION OF RURAL WOMEN

New Delhi .

Asal Baat News.

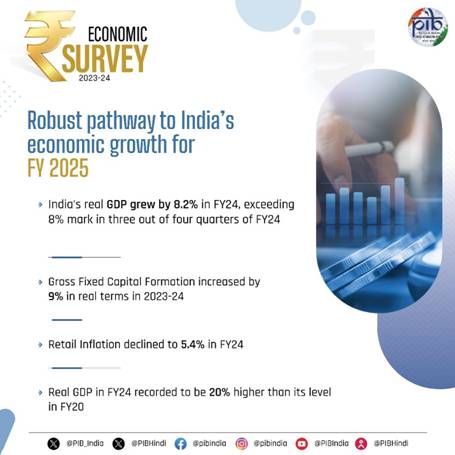

India’s real GDP is projected to grow between 6.5–7 per cent in 2024-25. The Indian economy recovered swiftly from the pandemic, with its real GDP in FY24 being 20 per cent higher than the pre-COVID, FY20 levels. This was stated by the Economic Survey 2023-24 presented in Parliament today by the Union Minister of Finance and Corporate Affairs Smt Nirmala Sitharaman.

The Survey points out that the domestic growth drivers have supported economic growth in FY24 despite uncertain global economic performance. It also adds that during the decade ending FY20, India grew at an average annual rate of 6.6 per cent, more or less reflecting the long-run growth prospects of the economy.

The Survey, however cautions that any escalation of geopolitical conflicts in 2024 may lead to supply dislocations, higher commodity prices, reviving inflationary pressures and stalling monetary policy easing with potential repercussions for capital flows. This can also influence RBI’s monetary policy stance. The global trade outlook for 2024 remains positive, with merchandise trade expected to pick up after registering a contraction in volumes in 2023.

The Survey highlights that leveraging the initiatives taken by the government and capturing the untapped potential in emerging markets; exports of business, consultancy and IT-enabled services can expand. Despite the core inflation rate being around 3 per cent, the RBI, with one eye on the withdrawal of accommodation and another on the US Fed, has kept interest rates unchanged for quite some time, and the anticipated easing has been delayed.

The Economic Survey says that India’s economy showed resilience to a gamut of global and external challenges as real GDP grew by 8.2 percent in FY 24, exceeding 8 percent mark in three out of four quarters of FY 24, driven by stable consumption demand and steadily improving investment demand.

The Survey underlines that the shares of the agriculture, industry and services sectors in overall GVA at current prices were 17.7 per cent, 27.6 per cent and 54.7 per cent respectively in FY24. GVA in the agriculture sector continued to grow, albeit at a slower pace, as the erratic weather patterns during the year and an uneven spatial distribution of the monsoon in 2023 impacted overall output.

"

"

"

"

"

"

" alt="" />

" alt="" />

" alt="" />

" alt="" />

.jpeg)